Company Update / Consumer Staples / IJ / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- 's 1Q24 net profit of Rp1.4tr (+3.1% yoy), came above consensus at 28% and in-line with ours at 25% of FY24F estimate.

- Sales normalization continues with Mar24 run-rate recovering to 3Q23's level (pre-boycott).

- Share price has dropped by -42% yoy which may have priced-in most of the negative; upgrade to Buy with TP of Rp3,000.

1Q24 profit beat from one-off royalty discount

booked 1Q24 net profit of Rp1.4tr (+3.1% yoy) and this wasabove consensus at 28% and in-line with ours at 25% of FY24F estimate vs. 24% 3-yr average (pre-Covid). Notably, the profit beat was driven by lower royalty costs (-33.6% yoy) following a review of actual expenses incurred to and being re-credited in 1Q24 - adjusting for this, net profit would have declined by -7.7% yoy. Management does not expect the royalty discount to be present for the remainder of FY24F.

Sales normalization post boycott with Mar24 run-rate reaching 3Q23's

1Q24 sales attainment of Rp10.0tr (-5.0% yoy) was in-line with expectations. Domestic sales decline of -4.7% yoy was attributed from unit volume growth (UVG) of +0.2% yoy and unit price growth (UPG) of -4.9% yoy. Sales continued to normalize with Mar24 sales run-rate recovering to 3Q23 level (prior to boycott). However, 's overall market share by value is still lower in Feb24 at 34.5% (vs. Feb23's 38.4%) - implying further room for normalization, in our view. Despite the -4.9% yoy UPG, GPM improved to 49.9% (+61bps yoy/ +156bps qoq) on the back of lower raw material price. At the opex level, continued to increase A&P spending with advertising expenses at 9.0% of sales (vs. 1Q23's 8.0%) and promotion at 4.2% of sales (vs. 1Q23's 3.5%).

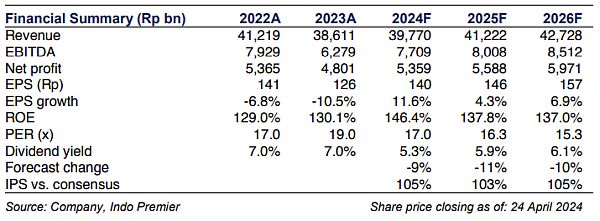

FY24/25F earnings cut of -9/-11% to reflect more conservative margins

We cut our FY24/25F earnings by -9/-11% on more conservative margins assumptions. In terms of cost inputs, we note that the stronger US$ may put pressure 's costs as c.30% of COGS is related to US$. Additionally, cost items such as CPO (+10.3% YTD) and oil (+14.3% YTD) have trended higher recently.

Upgrade to BUY with TP of Rp3,000/sh

Despite the earnings downgrade, 's share price has retraced by -42% yoy and has more than priced-in the weakness, in our view. remains a very efficient company (negative working capital) with strong balance sheet (net cash). Hence, we upgrade our call to BUY with TP of Rp3,000/sh based on 21.3x (-2.0 s.d from 5 yr avg). Risk is prolonged down-trading trend.

Sumber : IPS